A note from the CEO, Vishal Ghotge

“Today, our world calls for more connection, equity, and positivity. The Kiva community is in a unique position to drive that change.”

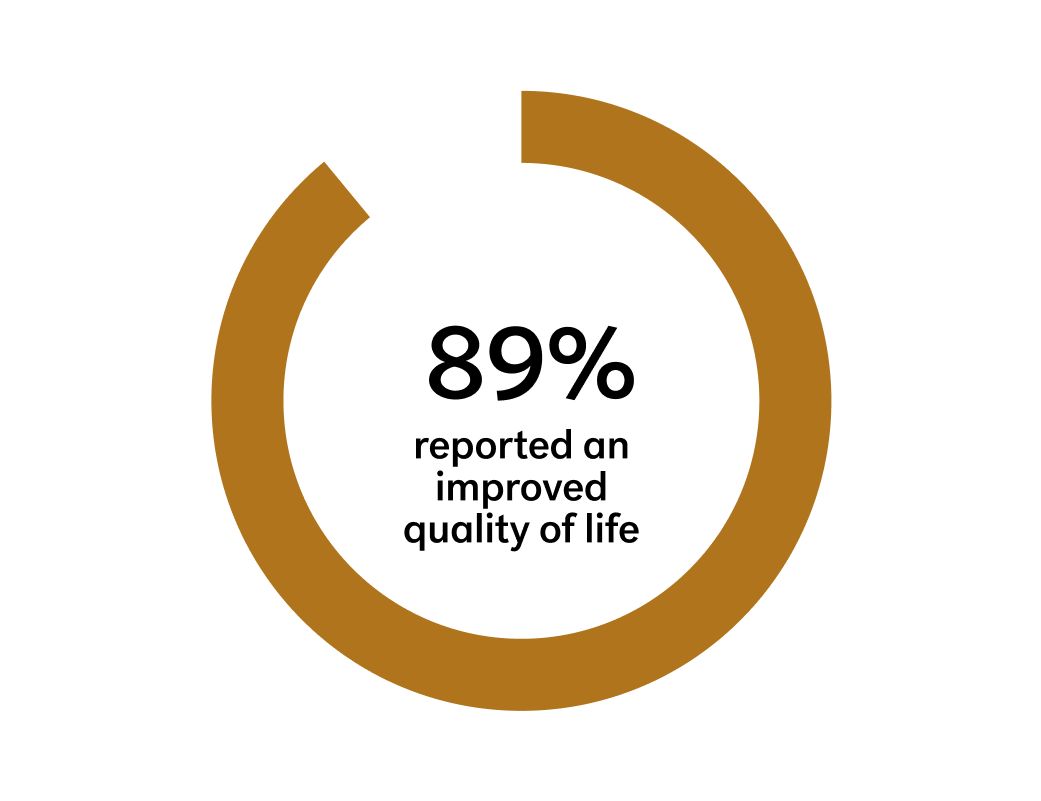

Looking back on 2024, I’m inspired by the strength and determination of Kiva’s global community. We came together to create opportunities where they were most needed, to expand financial access into new areas of the globe, and to be part of the good happening in the world. It’s why Kiva exists, and I’m grateful for your commitment. Your dedication helped Kiva achieve an incredible milestone last year: more than 5.5 million people reached since we began. To put that in perspective, that’s about the population of Norway. We couldn’t have done that without you. We also measured the outcomes of our work through a 60 Decibels survey, and I’m proud to share that 89% of borrowers said their lives were better overall because of loans provided through Kiva. This reminds me why Kiva is so essential, and of the collective power we have to change lives. Today, our world calls for more connection, equity, and positivity. The Kiva community is in a unique position to drive that change. Every loan funded, every community supported is a tangible step toward the future we believe in: one where everyone has what they need to thrive. Thank you for being with us on this journey. I hope you take pride in what we accomplished together. Let’s continue this momentum into 2025 and keep building a world of possibilities. — Vishal Ghotge, CEO, Kiva

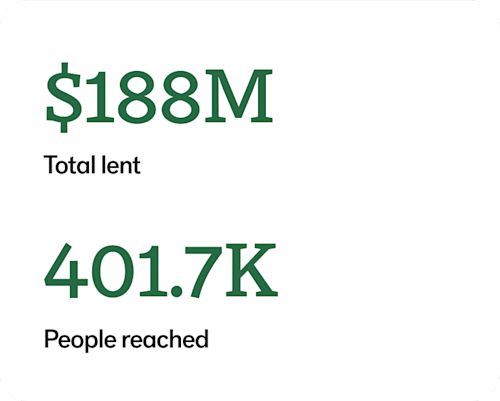

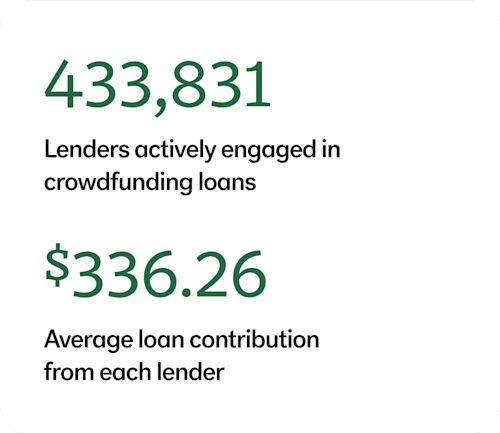

The Kiva community funded nearly 500 loans every day in 2024!

Impact highlights

You created real change for people in our four key impact areas

Together with Kiva’s dedicated community of lenders, donors, partners, and more, we’re creating a world where millions of underserved people can access vital financial services. To ensure we make the greatest impact possible, we focus on four key populations for increasing financial access.

79% of Kiva loans went to underbanked women

You gave women access to fair and equitable financial resources to improve their lives and pursue their dreams. Learn more →

315,867 women reached

$109,904,638 in loans funded

The Kiva community funded over 18.4K loans to refugees

Your loans were lifelines for people affected by forced migration, giving them resources to adapt and rebuild. Learn more →

41,919 people reached

$18,774,160 in loans funded

3 of 4 of Kiva U.S. loans went to BIPOC-owned businesses

You helped small-business owners invest in themselves and build their creditworthiness for the future. Learn more →

2,357 people reached

$7,529,500 in loans funded

Nearly 12K farmers gained access to networks and technical training

You helped people diversify their livelihoods and develop long-term solutions as the environment continues to change. Learn more →

43,248 people reached

$12,900,970 in loans funded

Agriculture was the most popular category for the Kiva community in 2024.

The outcomes of our work

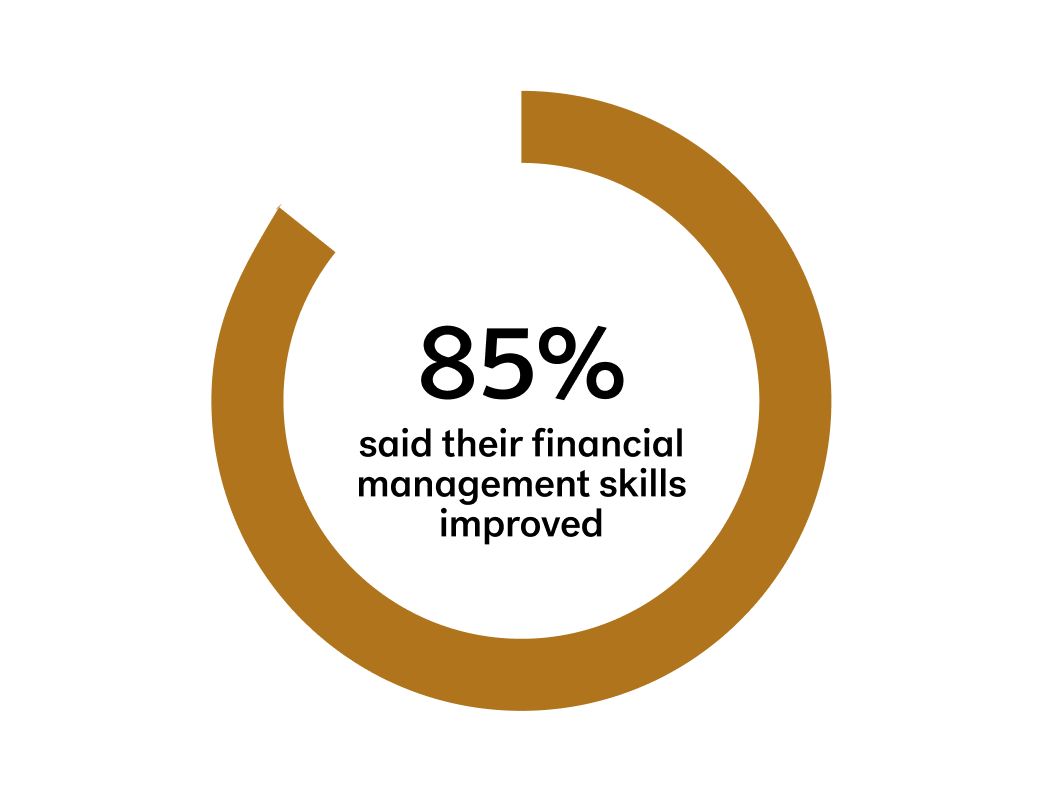

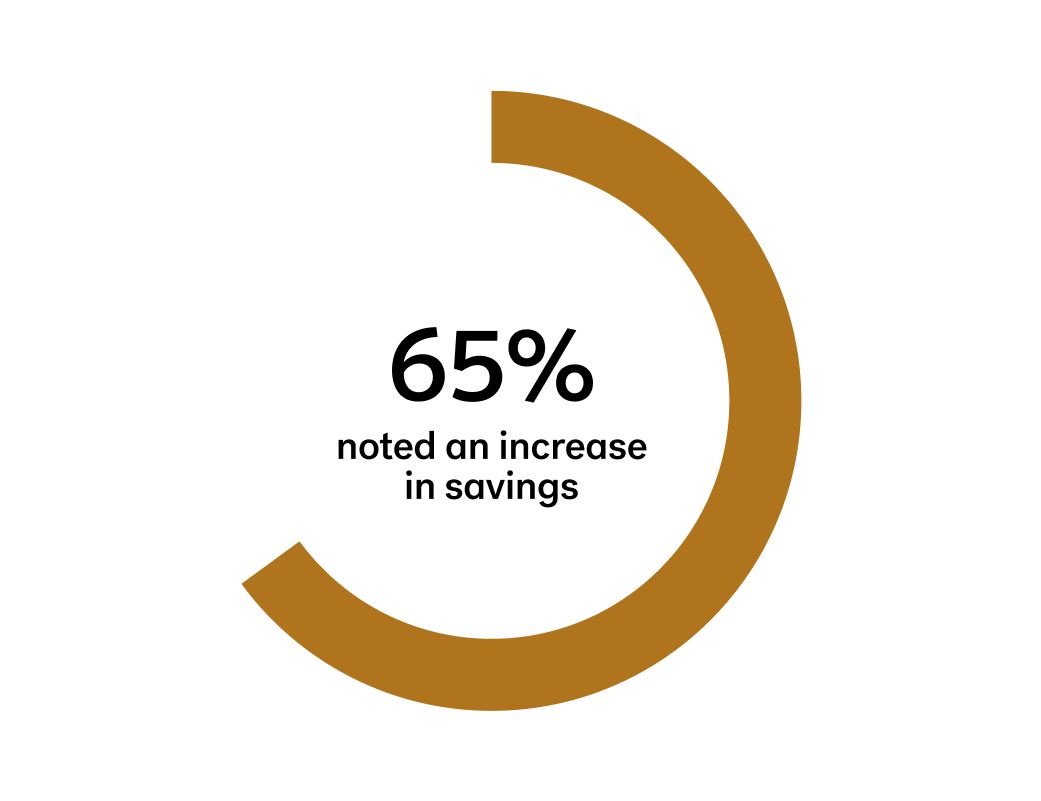

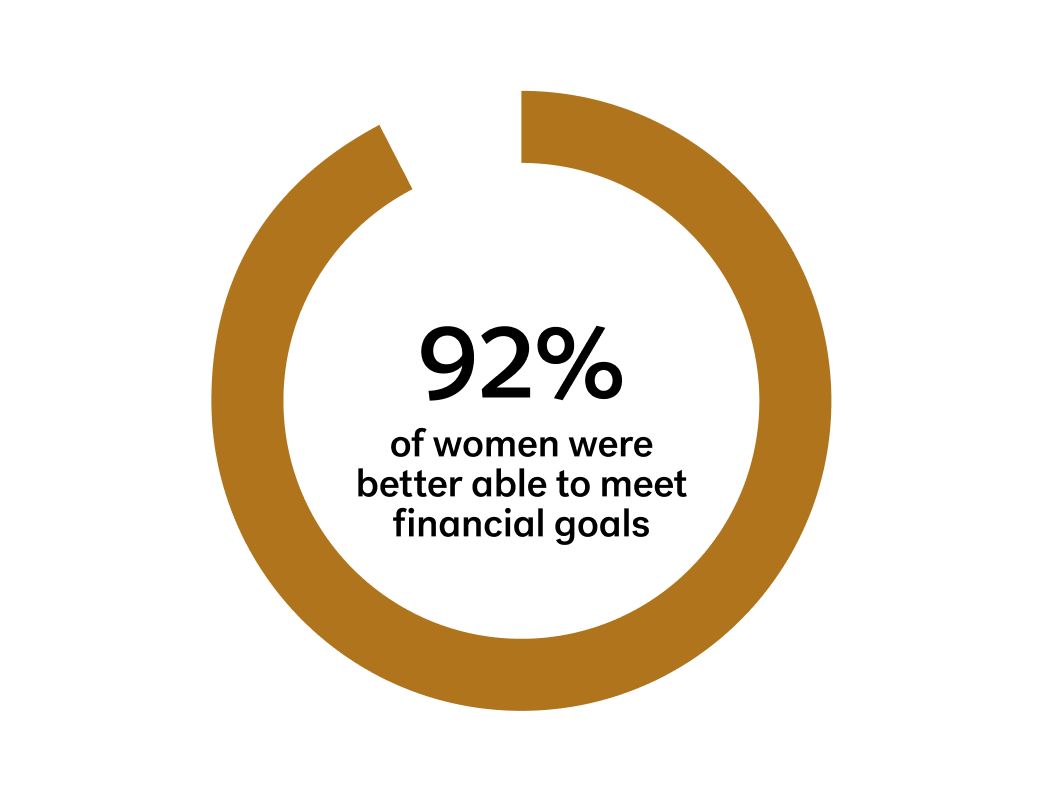

8 out of 10 borrowers said they increased their income

The most important part of our work is ensuring that Kiva loans have a positive impact on a person’s life. 60 Decibels, an independent social impact measurement company, surveyed borrowers working with 55 Kiva Lending Partners to assess the outcomes of receiving a loan, like better quality of life, improved sense of agency, and increased ability to handle the unexpected.

Kiva Lending Partners scored higher than global averages for positive borrower outcomes.

The Kiva community contributed over $4M toward water and sanitation loans!

Kiva launched innovative projects and initiatives to advance financial inclusion.

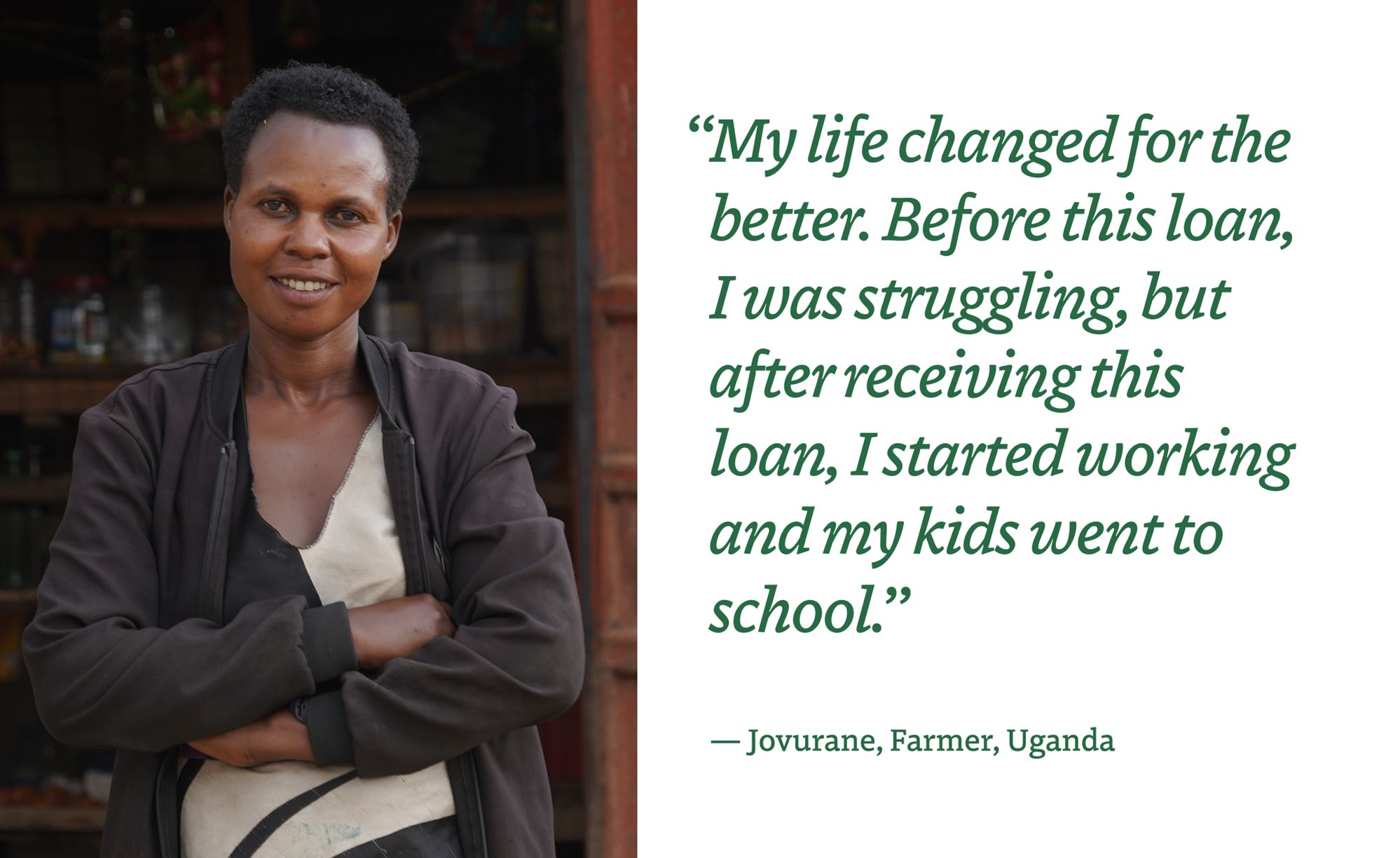

We established a sales center in Kyangwali refugee settlement with UGAFODE in Uganda, helping 330 people access savings accounts. Pictured: Grace, farmer, Uganda

Kiva launched an improved Impact Scorecard that includes a gender equity lens, collecting surveys from 163 partners. Pictured: Janaki Group, business owners, India

We helped promote financial literacy with ECLOF in Kenya, engaging and training 11,825 women. Pictured: Mary, store owner, Kenya

The Kiva community funded 202,875 loans on kiva.org to support borrowers’ goals.

Lending Partners and social enterprises brought financial access to new communities.

5 new Lending Partners joined Kiva from Rwanda, Uganda, Mexico, Uzbekistan, and Cambodia!

Half of climate-threatened people reached were supported via social enterprises.

Borrowers experienced real, meaningful change in their lives as a result of their Kiva loans.

11,158 people were able to access safe water and sanitation, a 45% increase from 2023.

Pictured: Jibu, water distributor, Rwanda

175,041 women invested in starting or growing their businesses. Pictured: Someone Somewhere, artisan collective, Mexico

15,659 people gained access to clean energy sources.

Pictured: Solenium, solar company, Colombia

We worked with strategic partners to expand our reach in key populations.

eBay Foundation committed an unrestricted grant to support key fundraising efforts in 2024.

eBay Foundation has been a partner in impact since 2016, when they helped Kiva expand their reach in the San Francisco Bay Area. Continuing their commitment to creating a more inclusive economy, the foundation awarded a meaningful grant in 2024, which Kiva used to match donations during critical moments like Giving Tuesday. This helped drive approximately $1.2M in donations from over 40,000 donors.

A $250K two-year grant from the GitLab Foundation is supporting a longitudinal study on Venezuelan refugees and internally displaced Colombian borrowers in Colombia, plus capacity building efforts.

Remitly engaged its global employees in honor of Immigrant Heritage Month and GivingTuesday. In just one year, they funded $143.6K to to 4.1K people in 58 countries.

Capital One is supporting entrepreneurs with a $3.5M three-year grant — $2.5M for zero-fee loans in the U.S, and $1M to improve the borrower experience.

News and awards

Gold Award for Partnership or Collaboration, and Silver Awards for Innovation and Diversity, Equity & Inclusion

World Changing Ideas Award with Honorable mentions for Finance and Developing World Technology

The Chief New Era of Leadership Award with Honorable mention for Resilience

Winner in Community Building and Best Use of Partnerships/Celebrity Endorsements

Join the Kiva community

Get Kiva news, borrower stories, promotional events, and more — right to your inbox.

In 2024, Kiva had lenders from 187 countries — that’s 96% of all the countries in the world!

Financial overview

Kiva’s uses a June 30 fiscal year-end. The above summary is from Kiva’s audited financial statements for the fiscal year ended 06/30/2024, which are separately provided in their entirety on our site here (as well as 18 month audited financials ending 6/30/2023). Given the relationship between Kiva entities, certain assets and liabilities are eliminated upon consolidation.

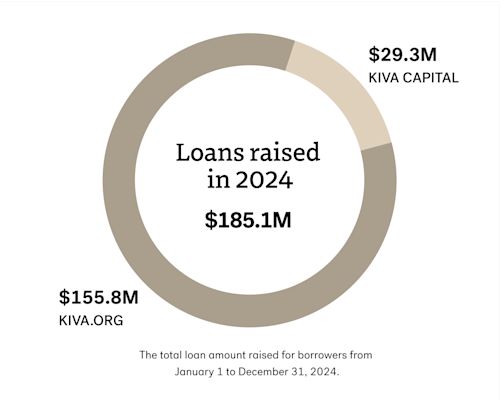

Loans and donations work hand-in-hand to advance financial inclusion

Kiva loans are critical, life-changing funds raised for borrowers around the world.

100% of the money lent on Kiva.org goes to supporting borrowers and their communities.

Kiva Capital unlocks and amplifies large-scale impact for underserved borrowers.

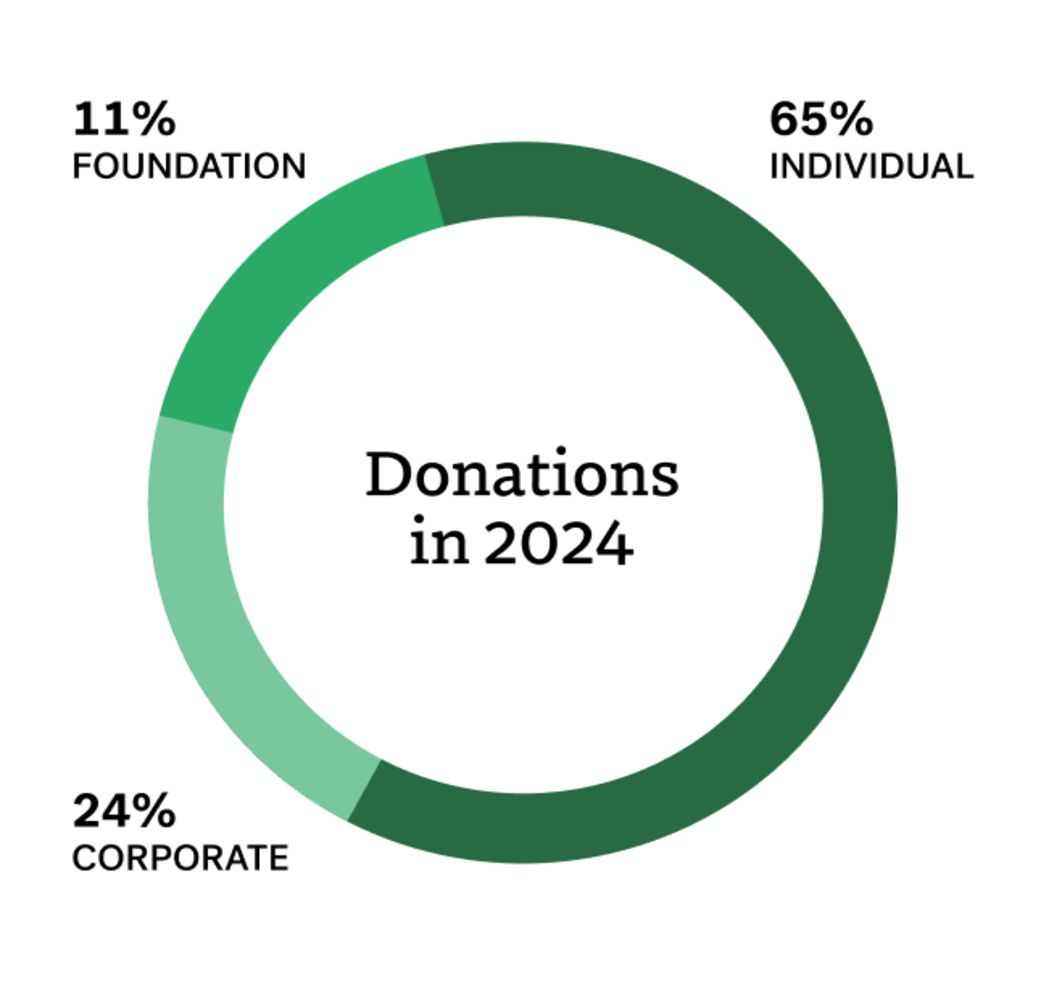

Gifts, donations, and grants

Your contributions power Kiva’s work, enabling us to innovate and expand our support for borrowers who otherwise lack access to critical financial services.

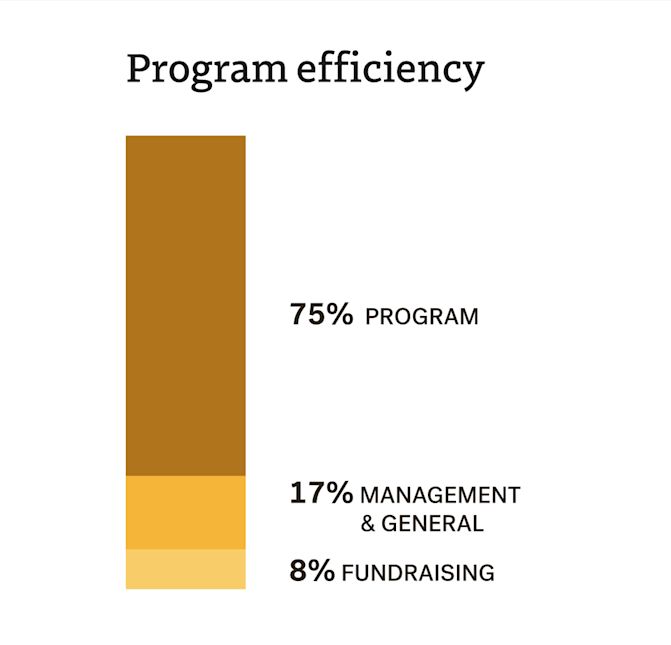

Operational expenses

As a nonprofit, Kiva efficiently manages operational expenses to achieve our mission of expanding financial access and ensure the greatest programmatic impact.

Your gifts help us carry out more capacity building work to drive real systemic change

The work we do to expand financial access takes a community — people that not only believe in financial inclusion but work together to make it a reality. Donations enable us to support borrowers at every step, from helping Lending Partners improve their services to investing in studies that tell us how loans are improving borrowers’ lives.

Thank you for an incredible year

The expansion of Kiva’s life-changing impact is made possible by our incredible community. Each of you have helped contribute to this milestone year and we are immensely grateful for your support. While we have much to celebrate and be thankful for, over a billion people continue to be financially excluded today, proving that our work is far from over. As we continue working toward achieving our mission of financial access for all, we invite you to join us in 2024, as we can do so much more together than we could alone. Thank you.

Thank you to these Kiva Community members — and so many others!

Loyal Donors

Laial Amado Sahil Ambani Ryan Arbogast and Angela C. Cook Kathryn V. Arnold Yury B. Daryl Benson David Berhenke John and Carol Blainey Gail Canizares Craig Chandler Joseph Cheung Chris Crabtree Andy Crossman Claudine and Michael Ferrante The Foti Trust Donor Advised Fund Ian Garcia Eric Grauvilardell Joshua and Susanna Greenberg Robert and Susan Greig Rolf Hertenstein Shawna Heninger Merle and Morton Kane Vera Kark Andy Kopra Nisha Ligon Tai Lopez Jenny Ludwig Jonathan and Belle Moncrieff Rebekah Montgomery Jon Moore The Namaste Fund Paul O'Sullivan Oyindamola Owoeye Darcy Palmer Fred Pounds Glen Reed and Reed Family Foundation Joff Redfern Matthew Sanchez Bev Skidmore and the Tomorrow Fund Mary K. Shorb-Smith Rick Silvestrini Daniel Smith Tom Southern Bret Strogen Samuel Test John and Marjan Wilkes Roland Wrinkle Benjamin Zigrang

Legacy Donors — In Loving Memory

Laurie Miller James Dennis Seyfert Suzanne F. Stultz Ana Wu

Supported by