Leoniya (right) had to flee the Democratic Republic of the Congo for Uganda, leaving everything behind — except for her motivation. With resolve to rebuild, she turned to Kiva. After opening a store, Leoniya used a Kiva loan to expand its inventory with sodas, water, and more, supporting her new community and family. Refugees like Leoniya aren’t waiting for rescue; they’re building new lives and futures. The Kiva community is simply opening doors for refugees by offering funding where banks won’t. Because displacement shouldn’t mean disempowerment.

When traditional banks shut refugees out, we open the door.

1 in every 70 people worldwide are currently displaced.

And the total number of displaced people is expected to rise to 300 million by 2030. Since 2016, Kiva has been a leader in lending to refugees. Through the Kiva community, people can get the resources they need to start businesses, create jobs, support their communities, and build a more stable future.

Kiva’s impact for refugees

Kiva has supported refugees and displaced people since 2016.

And we're committed to reaching 450,000 people by 2028.

Since 2016, refugee borrowers have repaid Kiva loans at the same rate as non-refugee clients — over 96% on average!

Learn more

Loans to displaced people transform lives

In order to provide finance to refugees and people impacted by forced displacement, Kiva partners with local organizations, called Lending Partners. According to an independent survey, displaced borrowers working with Kiva Lending Partners saw significant improvements after receiving their loan.

“If I hadn’t gotten this loan, we’d be very poor right now.”

“Back in Congo, I owned a business… everything was taken away from us. Here, I hustled for ways to start a business so that I could sustain myself. No one ever helped us. But the money we were given helped a lot. Now I’m able to bring water to the people in my community. I witnessed my children’s lives change.”

Read Mbazimutima’s story

Hope for the future starts here

Get inspiring stories, news, and ways to make a difference for refugees — delivered right to your inbox.

Rewriting the narrative around refugee financing

Despite the critical need, most financial service providers don’t lend to displaced people due to perceived risk — the assumption that refugee borrowers are less able or likely to repay their loans. But kiva.org’s work with refugees, and their 96% repayment rate, is showing that they’re just as creditworthy as non-refugee borrowers.

Read more on the blogScaling refugee lending programs with the support of kiva.org

Kiva’s proven track record is changing how the financial industry engages with displaced communities.

Helping more providers launch refugee lending

Our risk-tolerant funding from crowdfunded loans on kiva.org enables Lending Partners to pilot lending to refugees. This funding can also help partners maintain stable cash flow, ensuring they can continue lending even during times of crisis.

Supporting partners ability to scale lending to refugees

As financial service providers see that lending to displaced communities is viable, they grow their refugee client base. And after partnering with Kiva, many organizations are able to gain access to further funds from other investors, enabling them to expand their services further.

Bolstering partners’ capacity to serve refugees better

Supporting refugees takes more than funding — that’s why Kiva provides capacity building opportunities to Lending Partners. By investing in training, research, and advisory services, Kiva equips partners with tools to serve refugee communities more effectively.

Kiva’s capacity building support helps partners better serve refugee clients.

Kiva Lending Partner UGAFODE, a microfinance institution in Uganda, is committed to improving financial access for low-income and underserved clients. With funding from kiva.org, UGAFODE was able to grow its innovative programs and launch lending to refugees. As UGAFODE expands its refugee lending, Kiva has supported the organization with capacity-building efforts, helping to build a new office and launch operations in a new refugee settlement. In fact, the organization reported that Kiva’s support was instrumental in developing improved staff training, more tailored products, and ways of gathering client feedback.

Scaling lending to refugees with the Kiva Refugee Investment Fund

Building on the success of crowdfunding loans to people affected by forced displacement, in 2021, Kiva launched the Kiva Refugee Investment Fund (KRIF). This five-year fund has demonstrated that lending to displaced communities is a viable and scalable impact investment strategy for institutional investors.

Kiva’s impact through the Kiva Refugee Investment Fund

The Kiva Refugee Investment Fund invests in high-impact organizations driving financial inclusion for refugees.

Since September 2023, Armenia has become host to over 100,000 refugees due to the escalation of armed conflict in the Nagorno-Karabakh region. Through support from the Kiva Refugee Investment Fund (KRIF), FINCA Armenia has been able to expand its operations in this area to provide essential financial resources to communities affected by the crisis.

Learn more about KRIF

“Kiva’s entrance into our portfolio helped us to attract additional funding from other international institutions which were hesitating... This was a very important thing for us.”

— Anush Petrosyan, Chief Financial Officer, FINCA Armenia

Stand with refugees

For individuals

Make a loan

We’re more powerful together. Lend as little as $25 and help a refugee get the resources they need to rebuild after leaving everything behind.

For individuals

Make a major impact

From giving through your donor-advised fund to leaving a gift in your will, every donation powers our work toward expanding financial inclusion, including for refugees.

For individuals

Partner with us

Kiva partners align their philanthropic dollars with impact areas that reinforce their values. With Kiva, your organization can help refugees regain financial stability.

Changing lives through financial inclusion

From refugees escaping violence to the communities that host them, financial access is key to helping displaced communities build economic stability. Kiva focuses on expanding financial access to improve the lives of four key groups affected by forced displacement: refugees, internally displaced people, people at risk of forced migration, and impacted host communities.

Support a displaced person

Refugees

After leaving their livelihoods behind, refugees face prejudice and other barriers from traditional banks — and are denied the financial access they need to rebuild, start a business, improve their education, and create a fulfilling life in their new community.

Internally displaced people

Similar to refugees, Internally displaced people (IDPs) have had to flee to new communities, but remain within their home country. Facing economic challenges that negatively impact health, housing, and livelihoods, they need financial resources to regain their stability.

Host communities

As displaced people settle in new areas, host communities are more likely to experience strains on jobs, resources, and services. Fair financial access helps affected communities create long-term solutions.

People at risk of forced displacement

From climate change and food insecurity to natural disasters and political instability, financial access is crucial to helping millions of people build resilience to shocks and remain safely and sustainably in their homes.

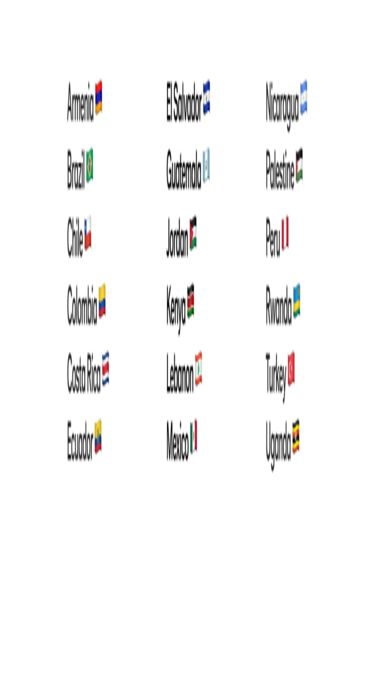

Countries where Kiva has supported refugees

Research and evidence building

Kiva is directly engaged in evidence building work to understand when and how lending to refugees is most impactful.

Explore the overlapping realities of refugees and displaced communities

21.5M people are displaced due to climate changes every year

Learn about Kiva’s work supporting climate-threatened communities →

Over 10% of Kiva borrowers in the U.S. are refugees

Learn about Kiva’s work supporting marginalized U.S. entrepreneurs →