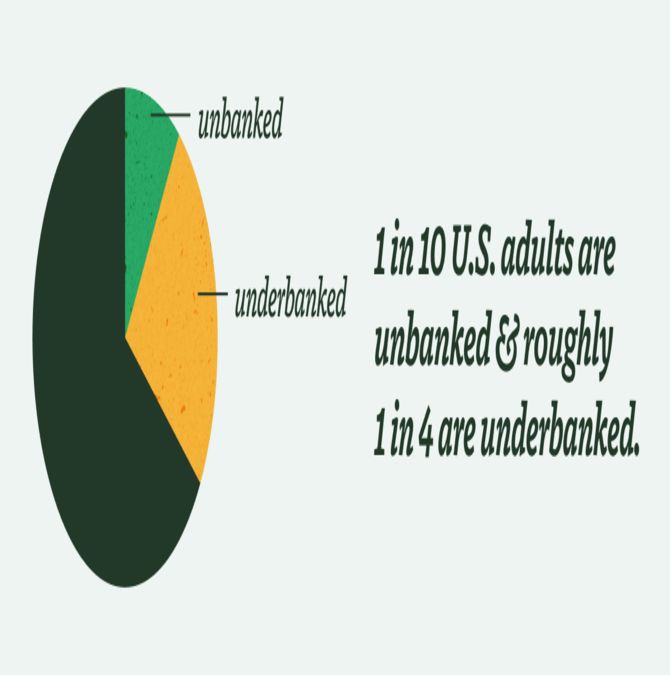

Kiva’s mission to expand financial access isn’t limited to lower-income countries. There’s an enormous need throughout the United States for financial equity and inclusion in communities that have been historically and systemically marginalized.

What does systemically marginalized mean?

“Systemically marginalized” refers to groups and communities that experience discrimination and exclusion due to a system of oppression—meaning patterns of behavior and policies that perpetuate economic and political disadvantages.

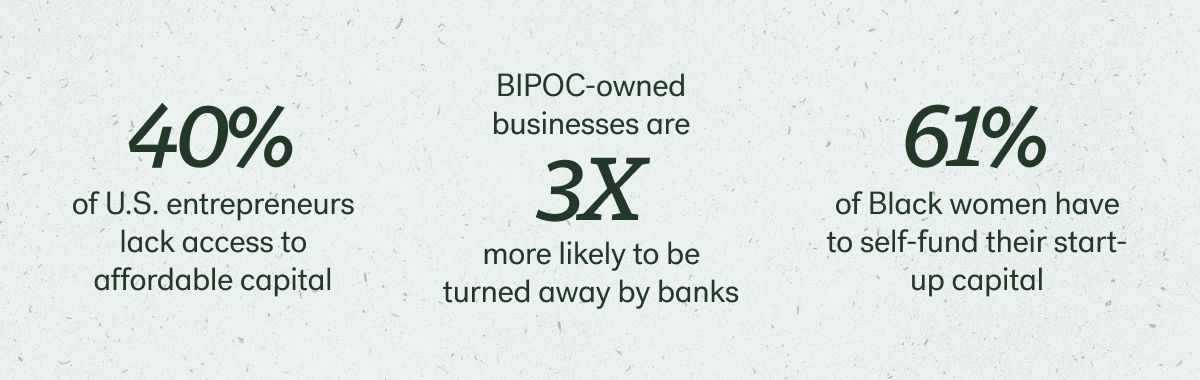

Marginalized entrepreneurs face financial discrimination based on race, gender, sexual orientation, and myriad socioeconomic factors. In our effort to open financial opportunity to all, Kiva has invested in expanding financial access for those that have been most excluded, including members of the LGBTQ+ community, refugees and immigrants, women and gender nonconforming individuals, Black and African Americans, the Latinx community, Indigenous people, and People of Color.

!["[Kiva’s] criteria about loaning money is specifically geared toward people like myself. People who are financially struggling. They do not discriminate by creed, color, or geographic area. They just help people." - Da’rrell, Kiva U.S. borrower](http://www.kiva.org/ctfassets/images/1l0acm4eq17mQWuuXtEPzL/299f118a38d158100a8f7ed6c03416c6/graphic_quote_1__1_.svg?w=335&h=452&fit=scale&f=center&fm=jpg&q=80)