The Pittsburgh area's rate of small business ownership was 5 percent per 100,000 adults, just below the national average of 6 percent.

Lend to small businesses in Pittsburgh

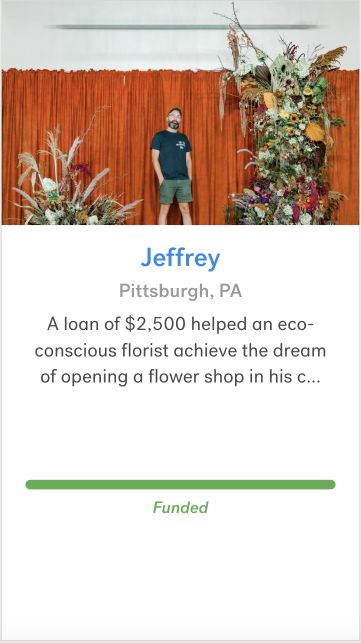

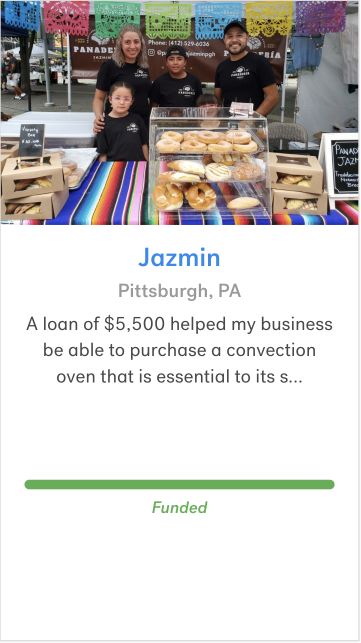

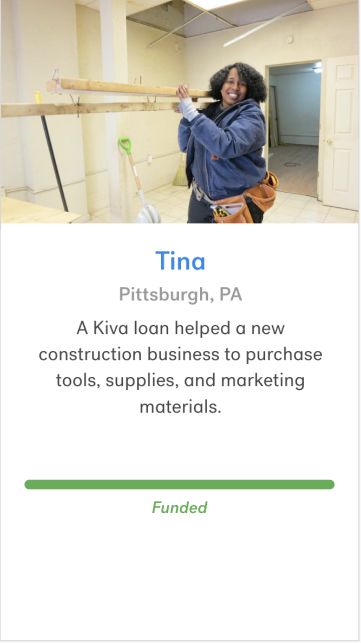

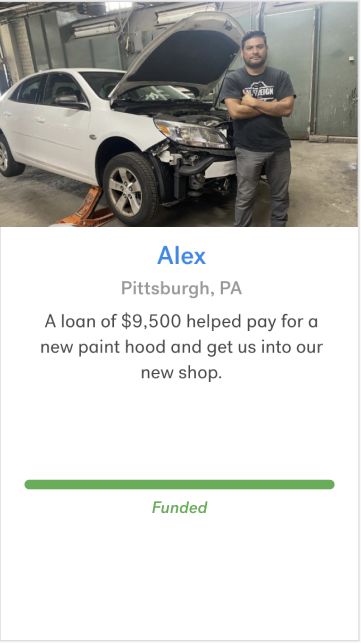

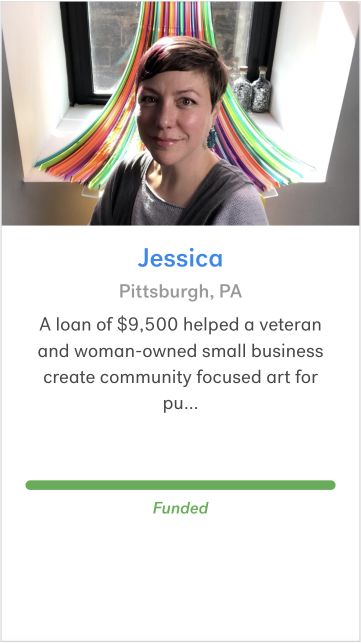

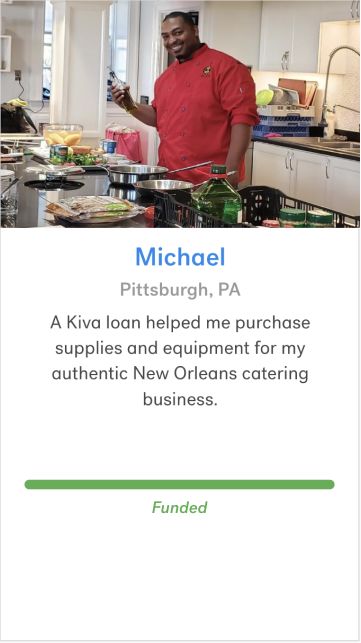

Successfully funded

Join the local Pittsburgh Lending Team

We believe that supporting small businesses in Pittsburgh and throughout Western Pennsylvania will help to strengthen our region's economy as well as our culture and community.

Join the Pittsburgh team

Riverside Center for Innovation's loan program for the underbanked

Riverside Center for Innovation (RCI) works to create a healthy environment for the region’s diverse entrepreneurs and small businesses to prosper. BIPOC entrepreneurs tend to bootstrap or seek grants and high interest rate loans, which are highly competitive and short-term. Affordable go-to market capital is almost non-existent for BIPOC-owned small businesses. RCI seeks to bridge this gap and provide a structure that allows stakeholders to invest directly into BIPOC communities. RCI hosts the Kiva Pittsburgh Hub, is a partnership with Kiva, an international nonprofit organization. Kiva Pittsburgh brings Kiva’s unique crowdfunded micro-loans ($1,000 – $15,000) to small business owners who may not otherwise have access to capital due to the entrepreneur’s length of time in business, poor or short credit history, or innovative business type or model. Financial inequity can happen anywhere, including underserved communities, and Kiva’s 0% interest, no-fee loans make capital accessible and affordable.