How it works

Subscribe & support

You decide who you want to support. Pick a category and we make sure 100% of your funds make it to them.

Stay up to date

Every month, hear from your borrowers. Discover their stories and many others around the world.

Multiply your impact

It's a loan, not a donation! Contributions and repayments let you help more people, month after month.

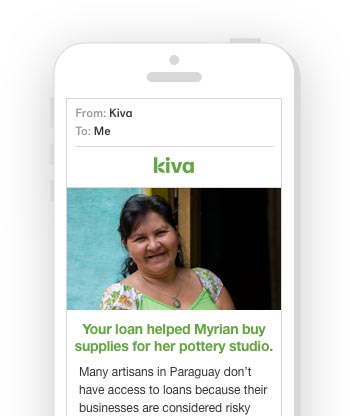

Monthly Good, delivered to your inbox

Once a month, we'll send you a dose of inspiration with an update on who your funds supported and how you’re making a difference.

20 years, $2.3 billion in impact

With nearly $2.3 billion in loans funded, Kiva is a leading global nonprofit creating opportunity for communities in need around the world. Your support will help us continue to push boundaries. Join the movement of 2.3 million lenders who’ve supported 5.5 million borrowers.

Kiva is an international nonprofit that believes in financial access for all.

We do this by crowdfunding loans, unlocking capital, and addressing the underlying barriers to financial access around the world. With Kiva, a small amount of money makes a big difference in someone's life.