Kiva uses crowdfunded microloans as a force for good, creating a space where people can have one-to-one impact, and together, expand financial access for all.

Jump to:

Kiva uses crowdfunded microloans as a force for good, creating a space where people can have one-to-one impact, and together, expand financial access for all.

Jump to:

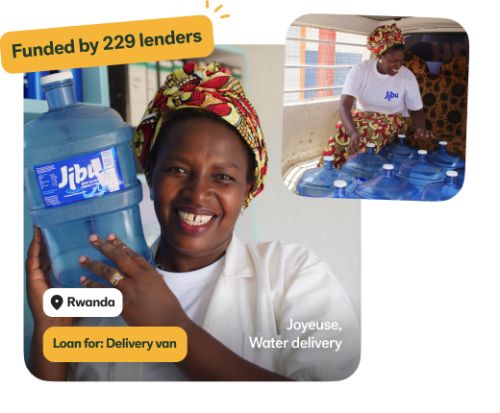

From a new fishing net to community solar power, it’s easy to help fund a loan that changes someone’s life.

Find a person you want to support

Decide how much you want to contribute

Check out—your funds are allocated to the borrower

Get repaid, and lend to someone else!

Still wondering, “But how do borrowers get their money?” or “How do lenders get repaid?” Let’s follow Margarita’s story to dig into how Kiva loans work from start to finish.

Margarita needs $1,000 to expand her tortilla business, so she applies for a loan with CrediCampo, a microfinance institution (MFI) and one of Kiva’s lending partners.

CrediCampo posts Margarita’s loan to Kiva.org to cover the cost of the loan, with editing and translation help from Kiva volunteers.

You see Margarita’s story and want to support her business. You lend $25 (or more!) to help crowdfund the full loan amount.

Thanks to you and 31 other lenders, Margarita’s $1,000 loan is fully funded!

– Margarita

100% of the loan amount is sent via wire transfer to CrediCampo, who provided Margarita with the capital she needs to invest in her business.

Margarita uses her Kiva loan to buy corn, gas, and firewood so she can improve production, increase her income to support her family, and keep her children in school.

(Kiva borrowers have a 96.4% repayment rate on average.)

As Margarita starts earning more, she begins sending repayments to CrediCampo, which are repaid to you and other lenders who helped fund her loan. These funds go straight into your Kiva account.

You can relend your funds to support another borrower again and again! Your dollars can travel the world, changing lives one loan at a time.

Contribute as little as $5 to help one of these borrowers achieve their dreams.

Not sure where to start? Try browsing loans by category!

But what about the billion people without access to traditional finance? That's where you—and Kiva—come in. Kiva loans give people the power and resources to build the life they choose. By crowdfunding smaller amounts—called microloans—we can help more borrowers get funded.

Decide exactly who you want to support and why.

Support causes you care about, from gender equity to organic coffee farming.

See that you’re making a positive impact in someone’s life.

Make a big impact, even if you don’t have a lot to give.

Yes, money is a finite resource. But with Kiva, you can use the same dollars again and again, helping a new borrower each time your loan is repaid. Your same $5 could help someone open a salon, then support a child’s education, then invest in community solar panels, and so on!

Jenae, Kiva Lender

Tiara, Kiva Lender

Nikolas, Kiva Lender

Ready to join the millions of Kiva lenders using crowdfunded loans as a force for good?

Lend todayKiva partners with microfinance institutions, nonprofits, and other organizations to disburse loans in the communities we serve. We choose partners who have fair, non-predatory lending practices and prioritize social good.

Financial inequity can happen anywhere, including underserved communities in the U.S. Learn more about our 0% interest direct loans for U.S.-based entrepreneurs.

Kiva never takes fees from lenders or borrowers. As a 501(c)(3), Kiva relies on donations, grants, and fees from certain lending partners to cover operational costs.

Most borrowers do pay interest to local lending partners to help cover their operation costs. We verify that these rates are appropriate for the region. Individual lenders don't earn interest—and 100% of money you lend goes to supporting borrowers.

Yep—Kiva loans really work, and often lead to improved financial wellbeing for borrowers. One study from a Kiva lending partner in Kenya found that farmers saw a 40% rise in income after receiving their Kiva loan!

Browse lending basics, find your account details, search for lending teams, or contact our amazing customer support team.

Get updates about how borrowers use Kiva loans to improve their lives, plus info about financial inclusion and ways you can help.